DCI Cost Efficiency Assessment

Enter the total annual cost of your employee health plan per employee: total gross premiums to cover all employees divided by the total number of participating employees (exclude dependents, which are included in our full analysis).

Provide the combined total of 401(k) management fees and fiduciary fees as a percentage of plan assets.

Divide the total WOTC credits claimed the previous year by the number of new hires (estimate is okay).

Divide fees from a recent credit card statement by total credit card revenue. Example: $8,473 fees / $311,387 revenue = 2.72%

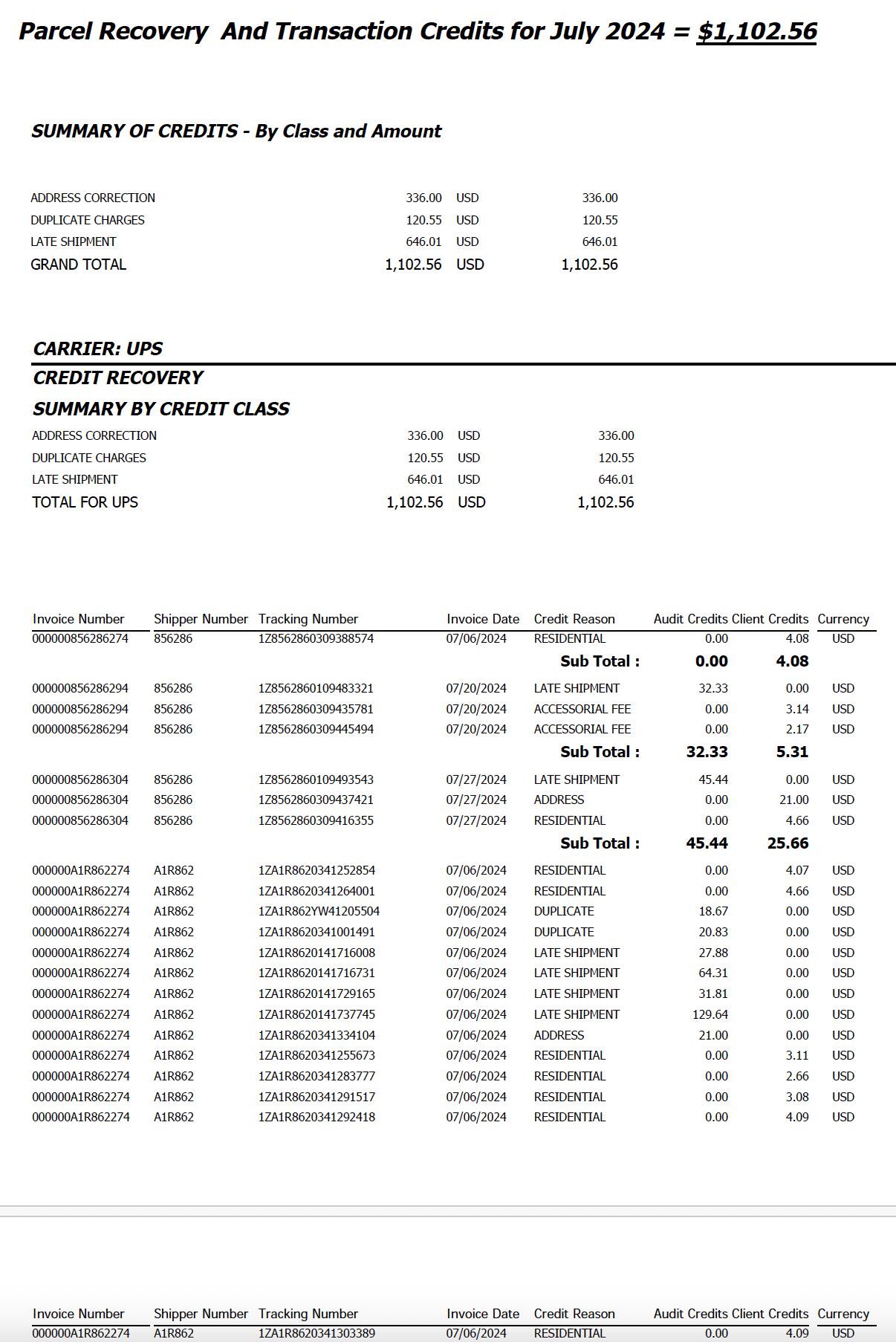

Enter the amount of refunds and credits issued to you by your freight carrier last month divided by the total amount shipped. Please click here to view sample report.

Enter your annual cost of payroll processing services per employee. This includes fees charged by payroll providers or in-house systems.

*Disclaimer*:

- Actual analysis surveys over 100 data points.

- This tool offers a basic understanding of cost performance, not a comprehensive analysis.

- Actual analysis surveys over 100 data points.

- This tool offers a basic understanding of cost performance, not a comprehensive analysis.